In its quarterly Inflation Report for April 2023, the National Bank of Ukraine presented mid-term forecasts that testify to the improvement of macroeconomic indicators. To some extent, this was unexpected, since the World Bank and the national Ministry of Economy have recently lowered the estimate of Ukraine's GDP growth in 2023 from 3.3% to 0.5% and 1%, respectively.

We have repeatedly pointed out that despite the crisis challenges and losses, the national economy demonstrates fairly quick adaptation to the new conditions. Moreover, although the national economy "easily" falls into the grip of a crisis, the recovery from post-crisis shocks will also be fast (albeit with losses), as witnessed by foreign trade indicators, being in the focus of this survey.

At the beginning of 2022, Ukraine's foreign trade was growing rapidly, contributing to the improvement of the macroeconomic environment, which began in 2021. However, already in February-March 2022, the situation changed radically as a result of hostilities on the territory of the country, significant human and material losses, and aggressive attempts to block international trade flows from/to Ukraine, which brought about a significant change in the macroeconomic structure of foreign trade.

Let's note some features of the dynamics of trade in goods in the recent decades:

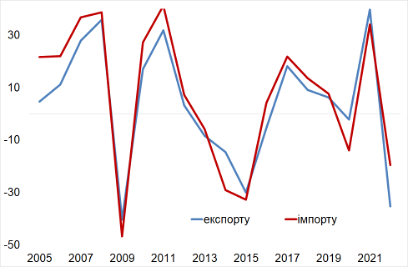

- in 2005-2021, the growth rates of imports usually exceeded those of exports (diagram "Export and import growth"), which caused a permanent deficit in trade in goods;

- in the previous crisis periods (2009, 2014-2015, 2020), imports fell much deeper, due to a sharp devaluation of the hryvnia, an increase in the price of imports, and the decreasing purchasing power of the population. In those years, the foreign trade deficit decreased significantly, reaching levels relatively "easy" to finance (in 2009, the deficit made 3.5% of GDP, in 2015 - 3.8% of GDP, in 2020 - 4.4% of GDP);

- however, as soon as in the next 2-3 years after the crisis shocks, imports resumed the forward dynamics, and the trade balance mostly became critically negative again (in 2011-2012 - a deficit of 11-12% of GDP, in 2017-2018 - a deficit of 9-10% of GDP ).

It is clear that the decline of exports in the post-crisis periods mainly occurred as a result of the loss of production and trade chains, a significant part of which could no longer be restored (e.g., the loss of Donbas in 2014-2015). Meanwhile, if in 2014-2015 the loss of metallurgical capacities was offset by the agricultural sector, in 2022, temporary occupation of the South, blockade of sea routes and destruction of the energy infrastructure significantly limited the growth of exports in the traditional niches.

At the same time, the post-crisis "thaw" was favourable for imports. The fact is that for the accelerated development of the country, imports (consumer and investment) are usually needed, and its (import’s) absence or decrease means a decrease in access to a wide range of investment needs and deterioration of the living standards. So, it is not surprising that the import recovery speeds up during such periods.

It should be noted that the factors and components of the crisis and its consequences were different in different periods; different industries or sectors felt negative pressure in different ways, but the general structure of export-import dynamics was the same. Secondly, domestic business found new niches quite quickly on its own, which was reflected in the significant growth of trade and reduction of the trade deficit.

Export and import growth, % compared to the previous year

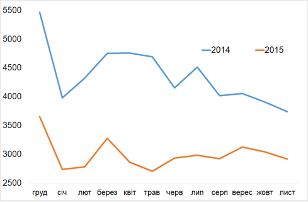

First of all, this concerns exports, facing tough competition on foreign markets. Stabilization and recovery of exports took place over only a few quarters (diagrams "Export of goods in 2014-2015", "Export of goods in 2019-2020"). Noteworthy, the increase in the export of goods during the coronavirus year of 2020 took place almost according to the scenario of the "calm" 2019. Moreover, such an increase started only after the first wave of the pandemic had partially "calmed down".

Export of goods, $ million (December of the previous year - November of the current year)

Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov

Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov

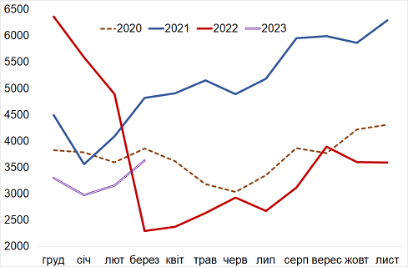

Taking into account said mutual influence, there are reasons to state that already in the current year of 2023, we will witness a gradual stabilization (and even increase) of the export of goods. Moreover, the current dynamics of the export of goods since the beginning of the year looks completely "familiar" (diagram "Export of goods in 2020-2023").

The grounds for good expectations also include the fact that, firstly, Ukraine, with the strong support from international partners, has begun using accessible logistics routes on the western border. Secondly, Ukraine and the EU agreed on the extension of the "business visa-free regime", which lets domestic businesses freely enter European markets (and will contribute to the growth of exports and recovery of the national economy).

This is extremely important for external balances, since in the near future the consumer demand in Ukraine (including imported goods) will be largely covered at the expense of humanitarian aid, which is badly needed for the social and humanitarian survival of the country. As for temporary restrictions on domestic agricultural products in some EU countries, there are reasons to expect that the European Commission will quickly find successful compromise solutions.

Export of goods in 2020-2023, $ million (December of the previous year - November of the current year)

Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov

While there are reasons to claim that the export of goods has been steadily recovering, the situation with the export of services is a lot different. It is better to talk about preserving trade in services.

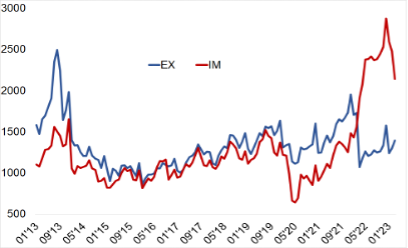

Usually, trade in services brought additional funds to Ukraine, as in 2013-2021, exports exceeded imports (diagram "Exports and imports of services"). Moreover, the deficit in trade in goods was "offset" by a surplus in trade in services. However, in March 2022 the situation changed dramatically - a sharp drop in export volumes, and with it - a rapid growth of the deficit in trade in services, which was superimposed on the growing deficit in trade in goods.

Export and import of services, $ million

The decrease in the export of services occurred mainly at the expense of transport services (a significant decrease in the export of air, sea and rail transport services). And if with time, the export of rail transport recovered a little, air and sea transportation will remain low for a long time (at least until the end of the war). In fact, today domestic companies cannot provide international services; as a result, they are substituted by foreign companies. Of course, we can be dissatisfied with this, but in reality the situation has a completely different interpretation - thanks to such quick substitution, the help, support and assistance of the EU countries to Ukraine became possible.

Taking into account the mentioned structural features of domestic exports, what areas of economic policy can be used to support exports? First, taking into account the fact that domestic businessmen will gradually restore their business, and with it, the readiness for export, the tasks of the development of logistics infrastructure and restoration of the production potential of technological goods must be prioritized.

Secondly, against the background of continuation of "visa-free" and suggesting that the speed of recovery of transport and provision of transportation from Ukraine to Europe will determine the possibilities of accelerating economic recovery in the country in general, the decisive factor is the structural renewal of railway transport, which concerns the construction and "switching" of the railway infrastructure from the post-Soviet track (1520 mm wide) to the European (1435 mm). This will connect the largest economic centres of Ukraine (Kyiv, Dnipro, Kharkiv, Odesa, etc.) with the western border and ensure transportation of goods from Ukraine to the EU countries "without stopping" at the border.

Thirdly, agricultural and food exports will remain an important factor in supporting the Ukrainian economy. Strengthening control over standards, practices and quality of production, use of appropriate tools and mechanisms for protection of plants and animals, provision of guarantees of environmental cleanliness will contribute to the competitiveness of the national economy.

https://razumkov.org.ua/komentari/zovnishnoekonomichna-stabilizatsiia