From the very beginning of its deployment, the crisis caused a significant ("synchronised") economic shock. The first measures to restrict the movement of people (both within the country and between countries due to the actual closure of borders), transport (including freight), closure of offices and businesses (followed with the loss of jobs) meant a sharp reduction in aggregate supply. The shock of supply immediately turned out to be a shock of demand, because the loss of work and "locking" people at home meant the loss of income, readiness for consumption, and purchasing power. The loss of employment in a very limited time affected significant and broad sections of the population, since the crisis immediately and simultaneously addressed and negatively affected almost all spheres of human activity.

Given the uncertainty of the continuation of the coronavirus pandemic, the main emphasis is put on macroeconomic trends, as well as on the already formed long-term relationships between key macroeconomic indicators for the case of Ukraine. This allows a cautious forecast that in 2021 Ukraine will be able to achieve a slight positive result — with the real GDP growth of 2.5%[1].

Ukraine: (un)readiness for crisis shock. Immersion of Ukraine into the next wave of crisis in 2020 did not come as an emergency event, but was quite expected (even if there had been no coronavirus shock). The economy of Ukraine was already entering into 2020 in a significantly weakened state, and therefore any imbalances could accelerate the economic decline. Quarterly dynamics of 2019–2020 witnessed the gradual weakening of the economy, which collapsed (as in most European countries due to coronavirus shock) in the second quarter of 2020 (table "Quarterly growth of real GDP ").

Quarterly growth of real GDP, 2019–2020

| І'19 | ІІ'19 | ІІІ'19 | IV'19 | І'20 | ІІ'20 | ІІI'20 | |

| % to the corresponding quarter of the previous year | 2,9 | 4,7 | 3,9 | 1,5 | -1,3 | -11,4 | -3,5 |

| % to the previous quarter by taking into account the seasonal factor | 0,8 | 1,0 | 0,3 | 0,0 | -0,7 | -9,9 | 8,5 |

Therefore, it is inappropriate to justify the failures and losses of economic policy in 2019–2020 by the coronavirus crisis. Rather, the crisis losses should be seen as another confirmation of the economic weakness of the domestic economy, which has deepened due to the low qualification capacity of the new government and the low efficiency of its economic policy.

Meanwhile, the registered growth rates of cases in Ukraine during the first wave (March-April 2020) were moderate, and therefore the country had the opportunity to "get prepared", taking into account international experience. This was not done, and the measures were chaotic and contradictory. As indicated, rational and balanced steps of authorities which enjoy the attention and trust of civil society, are extremely important for a successful and effective counteraction to the coronavirus crisis. However, in Ukraine, the reaction of society to the measures and actions of the authorities during the coronavirus crisis in 2020 turned out to be mostly negative, particularly the trust of citizens in government institutions — more than 50% expressed distrust in anti-coronavirus actions.

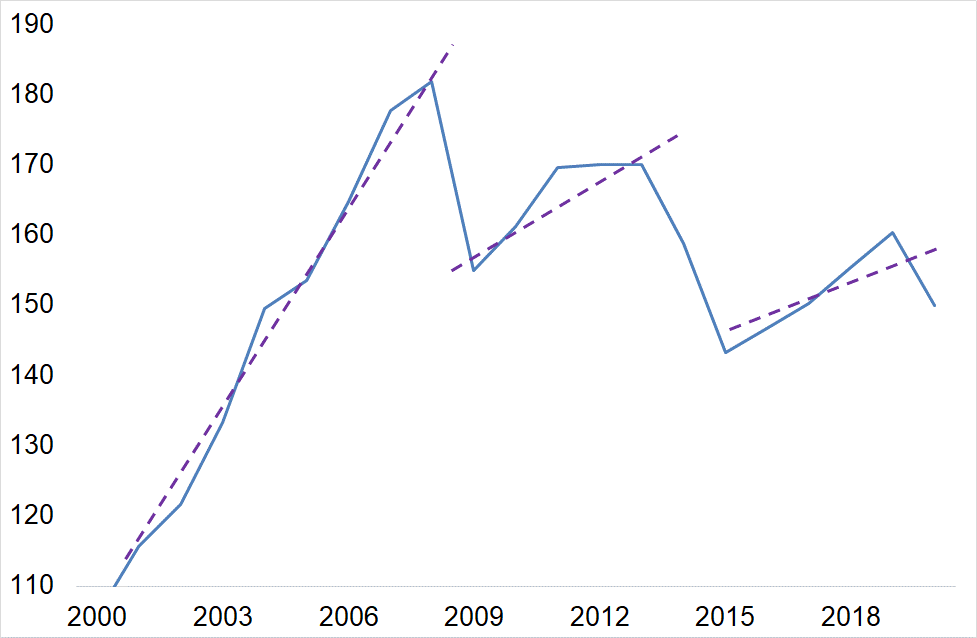

Dynamics of GDP and main indicators of the Ukrainian economy. Socio-economic results of Ukraine in the last decade remain extremely weak — growth rates have a noticeable downward trend[2].

Meanwhile, the economy of Ukraine in 2020 reached "stable" low economic dynamics. Thus, in 10 months (cumulatively, since the beginning of the year) there was a decline in industry by 7%, in freight turnover — by almost 16%, in the agricultural sector — by 14%. The annual figures will be about the same, and the fall in GDP will be 6.5%. This also leads to the establishment of the base of comparison for 2021, which (low base) will be able to "demonstrate" weak growth in 2021.[3]

Real GDP index (index, 1999 = 100)

Remaining unchanged over the years, are the structural shortcomings of the economy of Ukraine, with which the country entered 2020, and with which it also enters in 2021, are as follows:

- dominance in the structure of production of low value-added products, energy- and resource-consuming goods;

- practical lack of competition in the domestic market; its insignificant capacity, monopolisation and over-regulation do not allow the creation of appropriate conditions for the growth of competitiveness in general;

- the share of Ukraine in the most dynamic and high-tech markets is insignificant (no more than 5% of total exports of Ukraine are technological goods);

- expanding intervention of the government in economic decisions increases the deinstitutionalisation of the economy, the loss of interest of international business in entering Ukraine.

Therefore in 2021 Ukraine will be able to count on only minor positive changes, and only under the condition that a stable global acceleration is launched.

Moreover, it should be noted that a significant acceleration of coronavirus negatives and prolonged deployment of the second wave of crisis shock may reduce the performance of industry, freight and passenger transportation, domestic services industry, and thus — already accelerate the turning of the economy to depression in 2021.

In recent years, the country has managed to significantly reduce inflationary effects (reduce the value of the consumer price index CPI — to a single value), which contributed to the weakening of the inflation component on the formation of real GDP. However, the (official) level of consumer inflation (CPI) was determined mainly by the dynamics:

- food price index,

- housing and communal tariffs, the "regulation" of which means a periodic significant increase that leads to notable losses in the welfare of households.

Given the worse (than planned) harvest in 2020, in 2021 price characteristics of food for the population and the most important agricultural goods will increase, which will escalate inflationary risks in 2021. However, the freezing of wages and maintaining low capacity of the population will limit inflationary pressures, and thus — the CPI of 2021 will remain within 7–8%.

Along with this, the dynamics of producer prices (industrial products) in recent years has largely depended on the exchange rate dynamics of the hryvnia. Later we will return to the factors influencing the exchange rate dynamics of the hryvnia. Now we will just note that in 2021 there will be slight depreciation of the hryvnia — at a level that does not exceed inflation, while maintaining the relative stability of the real exchange rate, which will support the external sector (table "Growth of real GDP and main indicators").

Growth of real GDP and main indicators, % to previous year (unless stated otherwise)

| 2018 | 2019 | 2020(о) | 2021(п) | |

| Real GDP | 3,4 | 3,2 | -6,5 | 2,5 |

| Consumer price index (CPI), Dec-Dec | 9,8 | 4,1 | 5,6 | 7,4 |

| CPI, average for the period | 10,9 | 7,9 | 2,8 | 7,6 |

| GDP deflator | 15,4 | 8,1 | 7,0 | 8,5 |

| Course: UAH / $1 (average for the period) | 27,2 | 25,8 | 27,0 | 29,7 |

| International reserves, $ bn | 20,8 | 25,3 | 27,0 | 22,0 |

| months of imports of the nest year | 3,3 | 5,1 | 4,9 | 3,7 |

Risks and resources of growth. It is important to indicate a number of risks that can significantly worsen expectations and prognosis. First of all, they are institutional and structural losses.

(1). The macroeconomic structure of GDP is overly consumerist. The amount of final consumer spending in some quarters of 2019–2020 even exceeded GDP (for the relevant periods). Such an extremely high level of consumption is accompanied by exceptionally small resources that are saved and can be directed to investment. This erodes the growth potential in 2021 (table "Macroeconomic structure of GDP").

Macroeconomic structure of GDP

| 2019 | I'20 | II'20 | ІІІ’20 | 2020(о) | 2021(п) | |

| GDP, UAH billion | 3975 | 845,8 | 867,8 | 1156,8 | 3980 | 4420 |

| GDP, $ billion | 153,8 | 33,8 | 32,2 | 41,9 | 147 | 149 |

| % GDP | ||||||

| Final consumption expenditure | 95,2 | 107,8 | 99,6 | 87,1 | 97,5 | 96,0 |

| Gross capital formation | 12,6 | -5,1 | -2,7 | 15,3 | 6,0 | 7,5 |

| Export of goods and services | 41,3 | 45,1 | 40,9 | 35,3 | 39,6 | 41,1 |

| Import of goods and services | -49,5 | -47,8 | -37,8 | -37,7 | -43,1 | -44,7 |

(2). Due to the global slowdown in 2020, in 2021 both exports and imports will grow only slightly in both the world and Ukrainian economies. Ukraine, as a small open economy with a significant share of low-tech exports, is highly sensitive to external trade conditions. At the same time, the coronavirus crisis has changed the nature of world needs — with the reduction of world trade in industrial goods, there is an increased demand for agricultural goods and food products, which will maintain the trade balance of Ukraine.

In recent years, foreign exchange earnings from transfers of individuals working in EU countries have increased significantly. The net inflow of currency through transfers even exceeds the volume of FDI, and largely balances the trade deficit in goods. A similar situation will also continue in 2021.

(3). Economic recovery is positively supported by the transformation of monetary policy — the gradual transition from "inflation targeting" to monetary expansion. Strict adherence of the NBU to inflation targeting in 2015–2019 not so much had an impact on inflationary components, as it led to the maintenance of high interest rates, restrictions on crediting, and losses of long-term resources, encouraged the flow of funds to finance significant budget deficits, etc.

In the future, the NBU will pursue a more balanced and rational policy that will allow commercial banks to support an expanded money supply, which in its turn will stimulate the real sector, improve the provision of the real sector with money and credit resources, and at the same time increase monetisation and reduce money circulation. This consequently will reduce inflationary pressure (table "Monetary aggregates").

Monetary aggregates, growth, % to the beginning of the year (unless stated otherwise)

| 2019 | 6 months 2020 | 2020 (e) | 2021 (f) | |

| Monetary Base | 9,6 | 11,5 | 23,6 | 18,0 |

| Money supply (М2) | 12,7 | 12,1 | 25,4 | 20,0 |

| Money velocity (GDP/М2-average annual) | 2,9 | 2,8 | 2,5 | 2,2 |

| Credits to the economy from deposit banks | -9,4 | 2,5 | 2,1 | 11,1 |

(4). Currency and foreign debt positions cannot yet be considered stable. Although Ukraine remained limited in access to the financial resources of international financial institutes in 2020, however, Ukraine has fully and in due time fulfilled payments on external obligations; neither does the schedule of external payments for the first half of 2021 look critical for execution (table "Volumes of external payments in 2020–2021").

Volumes of external payments in 2020–2021, $ billion (as of 1.07.2020, adjusted on 1.10.2020)

| 2020 | 2021 | |||||

| Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | |

| Total | 4,84 | 5,83 | 4,72 | 2,33 | 5,33 | 3,08 |

| including | ||||||

| General Government (including OVDP4 owned by non-residents) | 2,49 | 0,48 | 1,42 | 0,64 | 3,32 | 0,79 |

| Central bank | 0,38 | 0,05 | 0,46 | 0,04 | 0,45 | 0,12 |

| For information: Hryvnia OVDP of non-residents, UAH billion | 5,48 | 2,33 | 8,91 | 4,20 | 8,14 | 4,71 |

OVDP — domestic bonds

During the first half of 2021, the government and the NBU together must pay about $2.5 billion, whilst the gross international reserves at the end of 2020 amount to more than $27 billion (which, at the same time, at around 5 months of imports) (table "Growth of real GDP and main indicators").

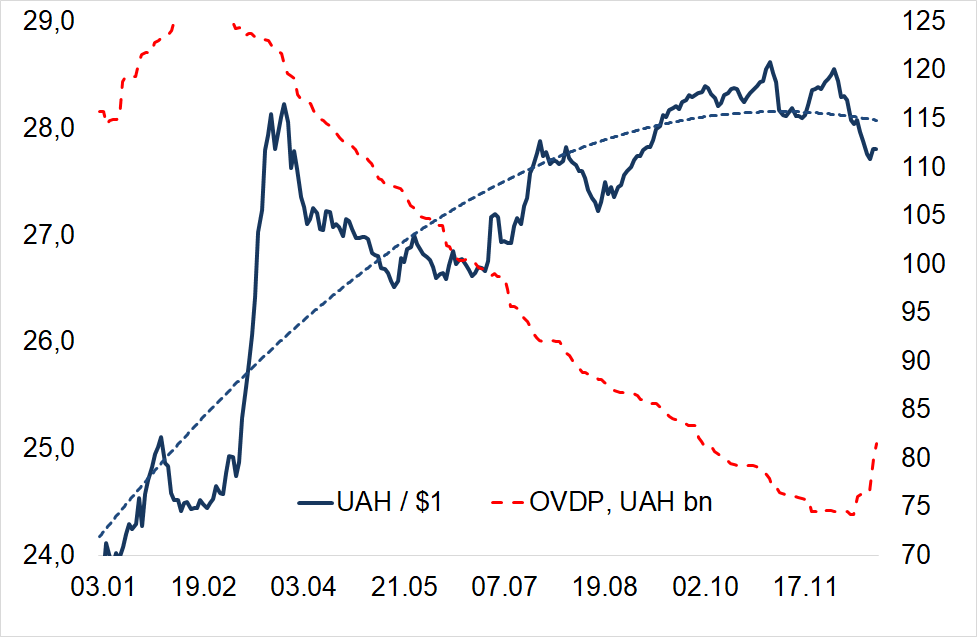

(5). Another stabilizing factor for currency and debt dynamics is the consistent exit of non-residents from the OVDP market[4]. The accelerated exit of non-residents (as a reaction to the beginning of the coronavirus crisis in March 2020) provoked a depreciation shock: if at the end of February 2020 the exchange rate was UAH 24.6 / $1, at the end of March it reached UAH 28.1 / $1. Tribute should be paid to the NBU — the exchange rate shock was successfully minimised due to mass interventions in exchange markets (which, although it meant the loss of reserves, led to stabilisation of the monetary and currency environments).

In future, the entry/exit of non-residents in/out OVDPs, which was accompanied by a weak appreciation/depreciation of the hryvnia, will not provoke new currency imbalances (chart "Volume of OVDPs owned by non-residents and exchange rate").

It seems that the weak depreciation quite satisfies the foreign economic sector and the banking environment and allows keeping interbank credit rates at a fairly low level. This gives grounds to claim that thanks to a weak depreciation of the hryvnia in 2021 it will be possible to achieve sufficient transparency and accessibility of credit markets.

Volume of OVDPs owned by non-residents and exchange rate, Jan–Dec 2020

In early December, unexpectedly for many experts, and despite not being connected to the IMF, Ukraine managed to obtain significant external resources — more than $1.5 billion. In addition to the return of non-residents to the OVDPs market (due to yield increasing), almost simultaneously the following took place:

- €600 million has been received from the European Commission (under the new macro-financial assistance program);

- $600 million of the additional issue of Eurobonds has been issued;

- $300 million from the World Bank has been received as additional funding to address the consequences of the coronavirus.

These revenues significantly improved the state of the international reserves of Ukraine, which exceeded $27 billion, and virtually removed currency and debt risks in the first half of 2021. Moreover, if in 2021 funding from the IMF and the World Bank is delayed again, Ukraine will be able to spend part of its reserves to prevent external pressures and imbalances (table above "Growth of real GDP and main indicators").

It should be recognised that in 2021 the risks and challenges in the Ukrainian economy will remain significant, and so far there are no factors that would give hope of a speedy recovery. Indeed:

- new incentives for the development of small and medium-sized businesses will not appear (announced initiatives to stimulate entrepreneurship are extremely insufficient for real recovery);

- the sectoral structure remains outdated — in the absence of investment, competitiveness will remain low and will not "catch up" with global challenges;

- access to financial and credit resources, although expanding, will remain limited;

- support for exports and exporters will not have adequate resources,

this, finally, DOES NOT ALLOW cause for hope in the restoration of stable positive dynamics of the real sector in 2021–2022. The expected weak positive dynamics of GDP in 2021 in many aspects will be caused mainly by the "(low) base effect" of 2020, and not by structural recovery or by strengthening the competitiveness of the country.

And only under the condition of institutional and structural changes, determination of strategic directions of actions, and depoliticisation of economic decisions, will it be possible to expect a certain acceleration of transformations which is associated with the vision of a risky but nevertheless positive scenario of the development of Ukraine in 2021–2022.

[1] Our forecast for growth in 2021 does not mean that the depression has stopped and the country has reached stable development. It should rather be interpreted that the economy has only "fought back" against the crisis and coronavirus shock, but it does not mean that the risks are already overcomed.

[2] It should, of course, be taken into consideration that the crisis of 2014–2015, in addition to internal factors, was exacerbated by Russian aggression, loss of people and territories, dispersion of economic potential, and other factors.

[3] Macroeconomic forecast indicators for 2020–2021 during 2020 repeatedly reviewed by various institutions. Among the latest, published in October 2020, the IMF forecast is the most "pessimistic" — fall in 2020 by 7.2%, growth in 2021 by 3%. — PMCG Research. Economic growth forecasts in Ukraine: 2020–2021, https://pmcresearch.org/publications_file/75005fbe1733e9f46.pdf.

[4] Although OVDPs are mostly denominated in hryvnias, the active participation of non-residents in this market (inflow of foreign currency to purchase OVDPs, and subsequent withdrawal of income converted into foreign currency) generates risks as characteristic for foreign debt instruments.